Asset Value:

₹ 80.4 Cr

Rental Income:

Distributed Monthly

Entry Yield:

9.6%

Target IRR:

15.1%

Tenant Lock-in:

5 years

Investment Overview

WiseX is offering a rare opportunity to invest in 58,661 Sq. Ft. of A+ Grade Office space strategically located in Viman Nagar, Pune. The proposed space is situated on the 9th floor of the newly constructed Sky One Corporate Park Building. The asset is located in one of the most sought after office micro-market in Pune with proximity to Pune International Airport and an upcoming Metro line. The tower houses numerous Blue Chip tenants. Our tenant, Vertiv Energy, has strategically expanded their footprint in the building, currently occupying in excess of 1.2L Sq. Ft. with further plans on expanding. The tower has been newly constructed with state-of-the-art construction technology to deliver superior quality. The building is already majorly occupied by blue chip tenants and is expected to be at 100% tenant occupancy by March 2024.

highlights

Sky One Corporate Park

- New Building : The Tower has been newly constructed with state of the art construction technology to deliver superior quality.

- Strong Tenant Demand : The building is already majorly occupied by blue chip tenants and is expected to be at 100 percent occupancy by March 2024.

- A-Grade Building : Designed for IGBC Platinum Rating [Pre-certified]. The building has state-of-the-art amenities including a gym, cafeteria, amphitheater, yoga room, creche and many more!

Gallery

Comparison Between Investments in Commercial Real Estate & Residential Real Estate

| Commercial RE (WiseX) |

Residential RE | |

|---|---|---|

| Distribution: | Monthly | Monthly |

| Rental: | 7%-9% | 2%-3% |

| Principle Appreciation: | 4%-9% | 2%-5% |

| Total Return(IRR): | 11%-18% | 4%-8% |

| Stability: | Long Lease Signed (9-15 Years) With MNC Tenants |

Unstable Tenancy Due To Short Lease Tenures With Individuals As Tenants |

| Risk: | Low | Medium |

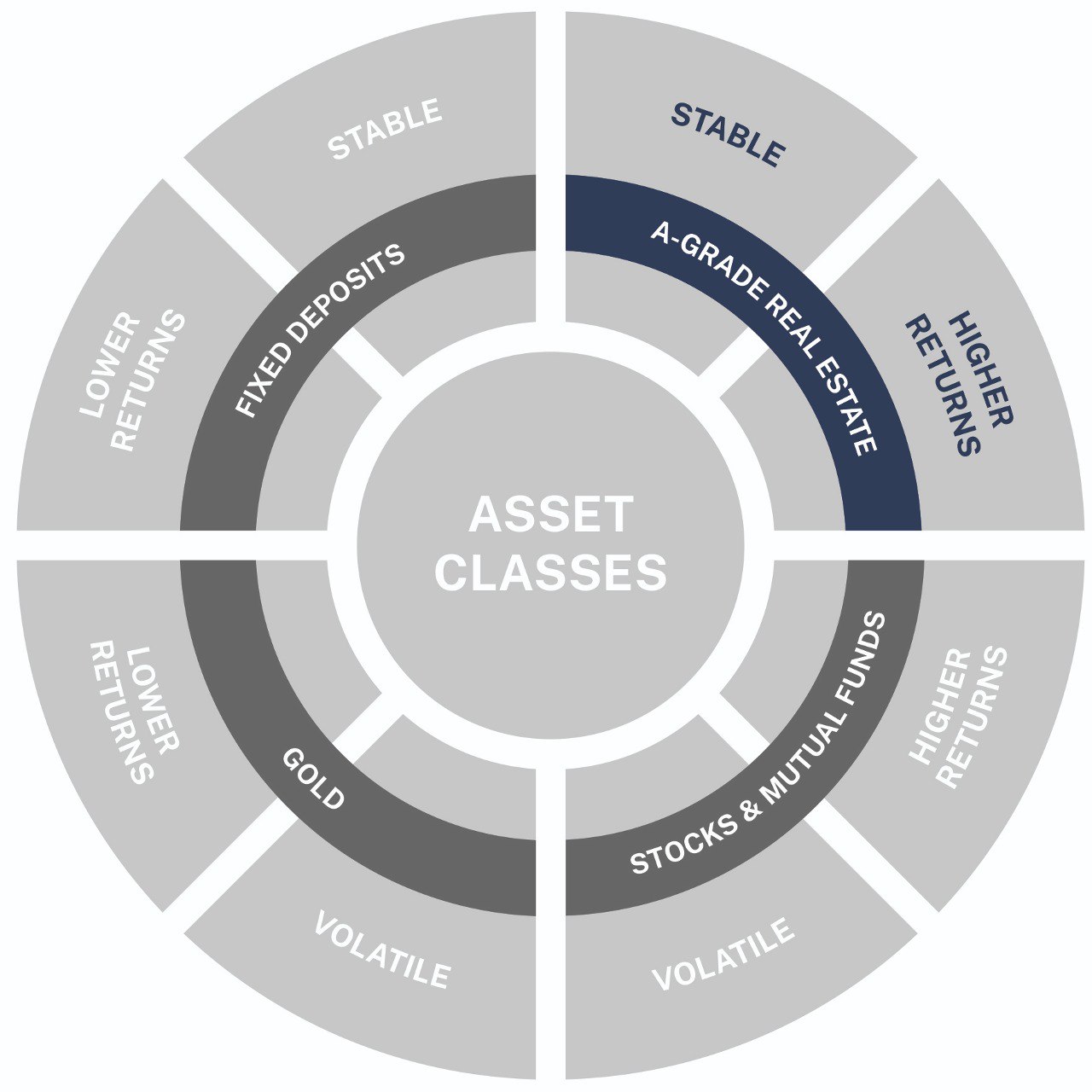

Why Commercial Real Estate Investments?

High Rental Yield

7%-9% rental yield with stable and predictable cash flow

Capital Appreciation

Year on year capital appreciation (17%-25% IRR)

Capital Preservation

Real estate is a hard asset that preserves capital

Stable and Non-Correlated

The performance of commercial real estate is not closely correlated with stocks and bonds

About WiseX

WiseX is India's leading Neo-Realty Investments platform that offers curated Alternative Investments in the Real Estate sector. WiseX brings institutional grade investment opportunities on the platform which were earlier only available with Ultra-rich making it accessible for all.

Investments Facilitated

₹+

Crores

Strong

Performance

%

On time collection & distribution of payouts to investors

Publications

& Awards

+

Featured in National & International

Registered

Users

+

From 20 + Cities & 16+ Countries

Why WiseX?

Monthly Income

Monthly returns from the point of Investment

Institutional Grade Opportunities

Less than 1% of the opportunities pass the stringent WiseX selection criteria

Access

Easy access to institutional grade investment opportunities at a fraction of the cost

Transparency

Transparent investment process, access to detailed reporting and complete costing disclosures

Convenience

End to end solution including identification, acquisition, management and exit

Data Driven

Data driven investment approach to identify the optimal assets based on 150+ data points

WiseX Fractional Ownership Portfolio

Office

Office

Magarpatta Cybercity - 1

Hadapsar, PuneTarget IRR:

18.5%

Average Rental Yield:

8.8%

Asset Value:

INR 24,90,00,000

Office

Office

Maker Maxity

BKC, MumbaiTarget IRR:

19.2%

Average Rental Yield:

8%

Asset Value:

INR 16,00,00,000

Office

Office

Magarpatta Cybercity – 2

Hadapsar, PuneTarget IRR:

17.7%

Average Rental Yield:

9.25%

Asset Value:

INR 26,10,00,000

Office

Office

Times Square Opportunity

Andheri, MumbaiTarget IRR:

13.6%

Average Rental Yield:

10.5%

Asset Value:

INR 31,10,00,000

Office

Office

Vaishnavi Tech Park I

Outer Ring Road Sarjapur, BangaloreTarget IRR:

16.2%

Average Rental Yield:

9%

Asset Value:

INR 35,40,00,000

Office

Office

Vaishnavi Tech Park II

Outer Ring Road Sarjapur, BangaloreTarget IRR:

15.9%

Average Rental Yield:

8.8%

Asset Value:

INR 35,70,00,000

Basking in the admiration of investors

I was impressed right from my first conversation with MYRE's Investment Manager. They provided me with clarity regarding fractional ownership and offered fantastic A-grade Commercial property along with all the due dilligence.

I am confident in investing my hard-earned money again in newer opportunities brought by team MYRE.

Puneet Bery - Founder, KSP INC Magarpatta Cybercity Investor

I have never been sure whether to invest myself in real estate, but MYRE Capital's opportunities are so well-curated,backed by research and transperent that it was pretty simple for me to trust them with my investments. I am constantly updated about my portfolio due to the fantastic technology they are using.

I has a wonderful experience with the team, and i'm looking forward to working with them in the future.

Samarth Bedi - Executive Director, Forest Essentials Magarpatta Cybercity Investor

i've always tried my hand at various financial options. I believe i found the best one at MYRE Capital which offers fixed income, capital preservation & appreciation, less risky, gives high returns that beat inflation & they offer grade-A commercial buildings.

The team is intelligent & hardworking. As a regular investor at MYRE, I will continue investing in CRE because the way they shortlist properties has given me enough confidence that my mney is ivested correctly.

Dhreej Bansal - Director of Engineering, athenahealth Times Square Investor

A delightful surprise waiting for me while I was on an overseas trip. A very kind gesture on the part of MYRE Capital.

I adore participating in environmental initiatives. I was pleased with my contribution to the WWF. I appreciate MYRE Capital's move and it will further solidify my relationship with the firm. I've also taken a few pictures of the hamper, and when i shared the idea with my acquaintances they also loved it.

25 lacs

25 lacs